Smart CYA protects personal liability for AML Compliance

If recent breaking news of a massive fine and AML banishment of a Chief Compliance Officer made you queasy, you’re in good company. The U.S. FinCEN last week dropped the other shoe—on the head of former Moneygram CCO Thomas Haider. Given Haider’s $250,000 fine and three-year banishment from the field, chances are that you agree this is a prime time to review the basics of AML CYA—Cover Your A**, and quickly.

It’s easy to be cheeky but the fear is real—and sensible. And it pervades AML Compliance departments. The crux of the problem, of course, is the ‘damned if you do and damned if you don’t’ position of AML Compliance teams who must simultaneously satisfy examiners without overly aggravating their employers and other departments whose bottom line is profit for the institution.

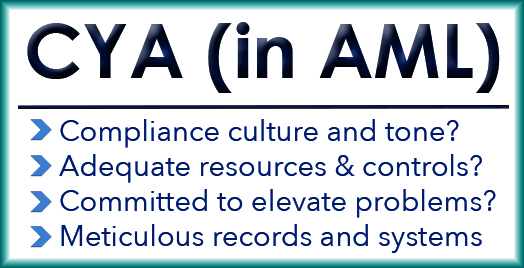

Attorney Ralph Sharpe analyzed this issue of personal liability in an ABA Compliance article in the spring of 2016. He urged Compliance professionals to ask themselves to evaluate their own exposure to personal liability by analyzing the following qualities of their Compliance workplace:

- Their institution’s culture of compliance and tone from the top

- Their institution’s provision of “adequate staffing, resources, and systems” to meet the risks faced by the institution

- Their institution’s embrace of effective controls to identify and manage risk before it gets out of control

- Their institution’s commitment to effectively elevating risk problems to senior management’s attention and intervention

- Their institution’s commitment to “keeping meticulous records that enable it to fully document issues and corrective measures taken.”

If any of these conditions trigger warning bells, according to Sharpe, a Compliance Officer may be personally at risk.

AML Partners’ CEO Frank Cummings has been working in the field of AML Compliance for well over a decade, and he has seen these types of high-risk environments engulf well-intentioned Compliance professionals and their institutions.

“AML Compliance officers naturally get caught in the middle,” Cummings said. “When an institution is implementing a true Risk-based Approach, perhaps it’s time for the naysayers to sign their names to their dissenting positions and make that part of the AML record. Marketing, sales, operations, and IT—they need to go on the record when they reject Compliance efforts related to mitigating AML and other risks.”

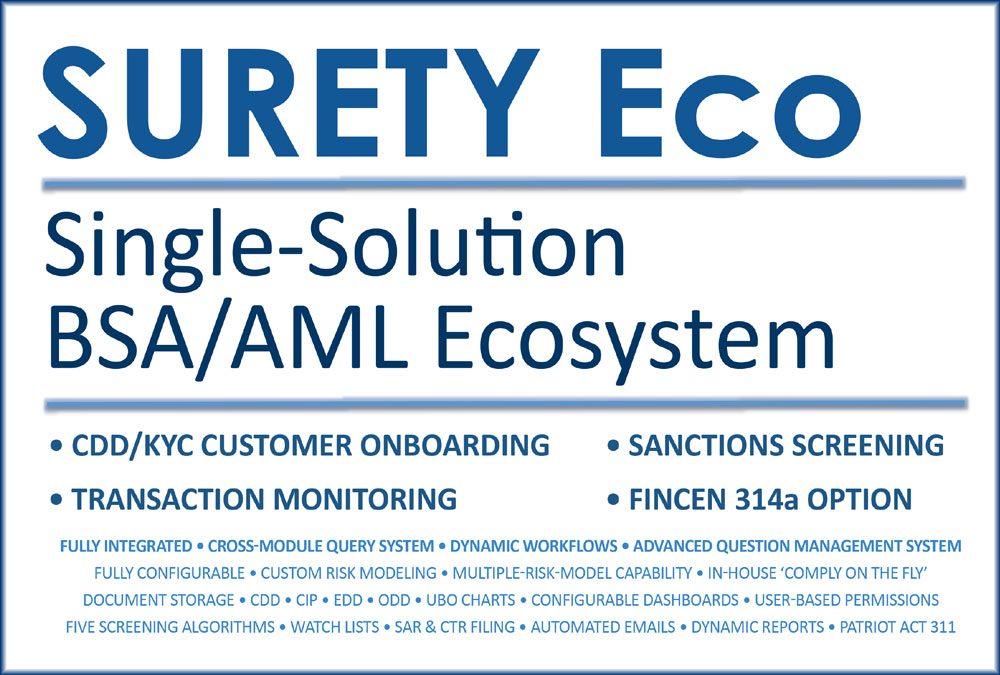

Cummings credits his early background in complex logistics and IT to his sensible-solutions approach in developing AML Compliance software solutions. Regarding an individual’s AML accountability, he built multiple safeguards into SURETY Eco, an AML software ecosystem.

“SURETY Eco is full of CYA-friendly features. Every AML software solution should be,” Cummings said. “CYA not only protects the Compliance individuals who must sign off on their institutions’ Compliance program, but it’s a safeguard for the institutions themselves not to let their business interests outrun their legal interests.”

Cummings cited the following CYA-friendly features of SURETY Eco:

- Complete real-time archive of every customer file and every action taken by every user

- User-based permissions that appropriately limit access to the AML Compliance workflow

- Dynamic workflow configurable by authorized user to ensure shared accountability distinct to each institution

- Robust email notification system that alerts users and workflow supervisors to time-sensitive tasks needing attention

- Dynamic Question-Management System to achieve mandatory collection of finely grained data related to risk

- Configurable sensitivity settings on screening results, including options to detect deceptive tactics such as concatenation

“These features are CYA 101,” Cummings said. “Spreading AML accountability among multiple individuals—and archiving their actions and logic—makes sense. And it makes for much better AML Compliance where a risk-based plan becomes action, and actions are archived actor by actor.”

These built-in features are just a few examples of the ways in which a top AML Compliance software solution like SURETY Eco supports the CYA objectives of both individuals and institutions. When a sensible Risk-based Approach is explicitly configured into an everything-is-on-the-record AML software solution, adhering to standards is a verifiable requirement rather than an individual’s choice—or an individual’s liability.

________________________________

SURETY Eco–The AML software ecosystem that features CYA for AML Compliance

AML Compliance benefits tremendously from systems thinking, specifically AML ecosystems. And with numerous built-in features that ensure CYA accountability and detailed archiving, SURETY Eco helps AML Compliance professionals achieve peak effectiveness and peak efficiency. If you’re ready to explore the power of the software ecosystem in your AML Compliance work, contact us today to learn more about SURETY Eco, the end to end AML Ecosystem. You’ll be amazed at the power of innovative problem solving and Ecosystem Thinking to transform the effectiveness and efficiency of your AML Compliance efforts and achievements.